Financial Strategies for Social Impact

by Liz McGeachy, Communications Director

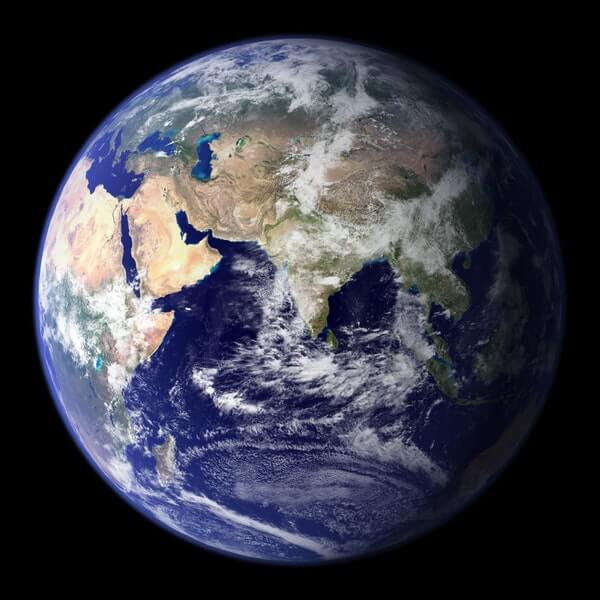

Most of us want to do our part in making the world a better place, but what’s the best way to go about it? Is it possible to use financial resources for positive change without sacrificing security and growth? At Chicory Wealth, we think the answer is YES. Many of our clients are interested in using their resources this way, as we are ourselves, so we’re happy to help sort out the best options.

The idea of using financial resources for social change is nothing new, but some of the strategies are fairly new, or they’re growing in popularity. We hear a lot of terms thrown about, and some of them mean different things to different people, so let’s try to pin a few of them down:

Charitable Giving. Philanthropy, or giving money to charities supporting work we value, is probably the most traditional form of financial social impact. This may mean giving directly to an organization we want to support or giving through a Donor Advised Fund (kind of like a charitable savings account). Giving to political organizations is another way to put money toward social change.

Socially Responsible Investing (SRI). This is an older term covering the broad strategy of considering a company’s social and environmental impact, as well as financial return, when deciding whether to invest in it or not. It may mean supporting companies in line with the investor’s values, or avoiding companies blatantly in contrast to those values, or both.

Impact Investing. While this term is often used interchangeably with SRI, it has a somewhat more complex meaning because it can include directly investing in small companies or start-ups that are not traded in the public markets. Right now, investments of this kind are generally the purview of ultra-high net worth individuals or institutions that can dedicate a portion of their assets to private equity and “venture capital,” wherein the investments have a clear social purpose.

ESG (Environmental, Social and Governance). This term is more common today than SRI, but they’re related. These are the broad factors often considered in socially responsible investing, namely, support of the environment, social justice issues, and the governance of corporations. Investors may run their investments through an ESG “screening,” which includes many factors, to determine how well a portfolio stacks up in these particular areas.

Shareholder Advocacy and Proxy Voting. If you own stocks in a corporation, you can influence the management of the corporation by voting for or against shareholder resolutions. The shareholder may do this as an individual (online or by mail) or ask their financial advisor or broker to do it for them. There are plenty of resources to help shareholders with this strategy. As we work closely with the Women Donors Network, we recommend taking a look at the 2018 “Proxy Preview” prepared from them by As You Sow for a deeper dive into this strategy.

Social impact investing and shareholder advocacy used to be somewhat fringe strategies, but not anymore. Today ESG investing accounts for one out of every five dollars invested and is becoming more mainstream. The market is definitely taking notice of the fact that companies that rate higher in these types of screenings often perform better over time. You can read more about that in this article in Investment News.

If you’d like more information on any of these strategies for integrating your values into your financial life, please reach out and we’ll be happy to tell you more.